WHAT IS A CREDIT CARD?

A Credit Card Account is like a Bank Account. A Credit Card is used to withdraw money from an account for which you pay back later. When you sign up for a Credit Card, you are effectively signing up for another bank account with an overdraft limit. Your Credit Card Credit Limit is your overdraft limit.

The big difference between a normal bank account and a credit card account is that you do not have to pay back the money you spend for up to 60 days. This is very different from your normal bank account where the money is taken from your account when a payment goes through it.

You receive a statement, NOT an invoice, each month from the credit card company. The credit card statement lists each transaction charged to this account. You should have received a credit card slip for each transaction AND an invoice or receipt from the supplier. The credit card slip is not an invoice. You cannot claim VAT back using a credit card slip, you must have an invoice.

How do you treat a credit card account, as a supplier account or a bank account? Well you can treat it as either or even both. In most cases setting up the credit card as a normal supplier will suffice. You can then treat the credit card statement as one big invoice, but in order to do this you will have to analyse each transaction on the statement.

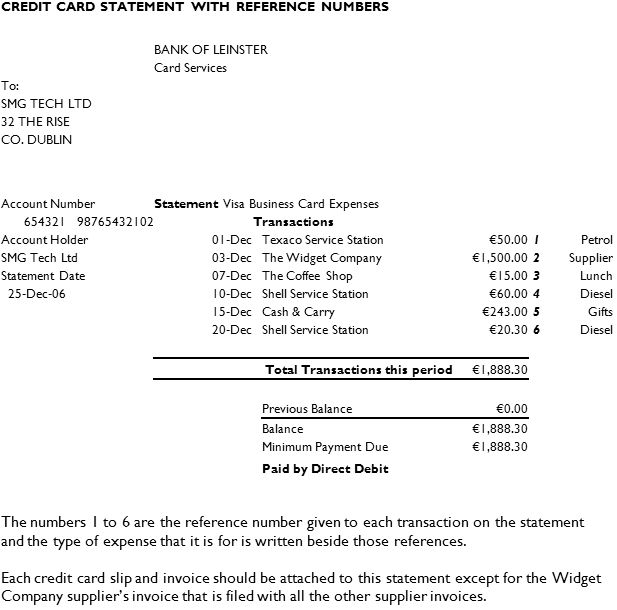

CREDIT CARD STATEMENT WITH REFERENCE NUMBERS

BANK OF LEINSTER Card Services To: SMG TECH LTD 32 THE RISE CO. DUBLIN

Account Number: Statement Visa Business Card Expenses 654321 – 98765432102 – Transactions Statement Date: 25-Dec-06

| 01-Dec | Texaco Service Station | €50.00 | 1 | Petrol |

| 03-Dec | The Widget Company | €1,500.00 | 2 | Supplier |

| 07-Dec | The Coffee Shop | €15.00 | 3 | Lunch |

| 10-Dec | Shell Service Station | €60.00 | 4 | Diesel |

| 15-Dec | Cash & Carry | €243.00 | 5 | Gifts |

| 20-Dec | Shell Service Station | €20.30 | 6 | Diesel |

| Total Transactions this period | €1,888.30 | ||

| Previous Balance | €0.00 | ||

| Balance | €1,888.30 | ||

| Minimum Payment Due | €1,888.30 | ||

| Paid by Direct Debit |

The numbers 1 to 6 are the reference number given to each transaction on the statement and the type of expense that it is for is written beside those references.

Each credit card slip and invoice should be attached to this statement except for the Widget Company suppliers invoice that is filed with all the other supplier invoices.

CREDIT CARD ANALYSIS

Credit Card A/c BAN001 – Bank of Leinster Date: 25-Dec-06 Account No. 654321 98765432102

| Suppliers | ||||

| A/c Code | Name | Ref | Amount | |

| WID01 | The Widget Company | 2 | 1,500.00 | |

| Total | 1,500.00 |

| Expense Analysis |

| Petrol | ||||

| Ref | Gross | Net | Vat 21% | Vat 13.5% |

| 1 | 50.00 | 50.00 | 0.00 | 0.00 |

| Total | 50.00 | 50.00 | 0.00 | 0.00 |

| Lunch | ||||

| Ref | Gross | Net | Vat 21% | Vat 13.5% |

| 3 | 15.00 | 15.00 | 0.00 | 0.00 |

| Total | 15.00 | 15.00 | 0.00 | 0.00 |

| Diesel | ||||

| Ref | Gross | Net | Vat 21% | Vat 13.5% |

| 4 | 60.00 | 49.59 | 10.41 | 0.00 |

| 6 | 20.30 | 16.78 | 3.52 | 0.00 |

| Total | 80.30 | 66.37 | 13.93 | 0.00 |

| Gifts | ||||

| Ref | Gross | Net | Vat 21% | Vat 13.5% |

| 5 | 243.00 | 200.83 | 42.17 | 0.00 |

| Total | 243.00 | 200.83 | 42.17 | 0.00 |

| Summary | ||||

| Totals | Gross | Net | Vat 21% | Vat 13.5% |

| Expenses | 388.30 | 332.20 | 56.10 | 0.00 |

| Suppliers | 1,500.00 | – | – | – |

| Grand Total | 1,888.30 | – | – | – |

Attach the credit card analysis to the front of the credit card statement and you have the full detailed analysis of the credit card completed.

If you have many credit cards then set up an a supplier account for each credit cards and prepare a credit card analysis sheet for each credit card statement.